A understanding of the Time Value of Money and the inter relationships between IRR, NPV, XIRR and XNPV are the basic building blocks of finance.

When Albert Einstein was once asked what mankind’s greatest invention was, he replied: “Compound Interest”. There’s even one claim that Einstein called compound interest the “8th Wonder of the World.”

These are also the first step to decipher equipment leasing. As we go along, we will look at different equipment, lessor landscape, leasing regulations including how to differentiate between an operating lease and a finance lease. And all this will require that we first master this blog.

We will often compare apples and oranges! And this understanding of Time Value of Money and its associated formulae will help us do this smoothly.

This is Part 1 of a 2 part series on Time Value of Money.

1. Time Value of Money

Time Value of Money simply means that money now is worth more than the same absolute value in the future.

To take a simple example – Rs. 100 today is more valuable than the same Rs. 100 in the future.

Additional Reference Material

2. Simple vs. Compound Interest

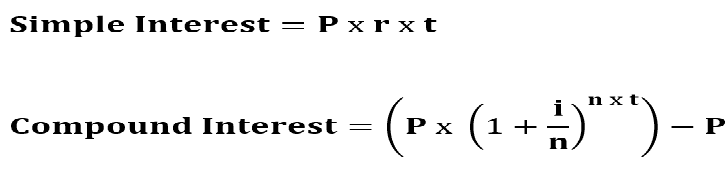

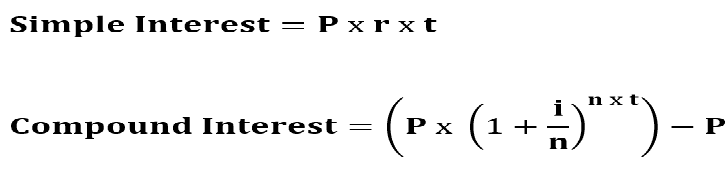

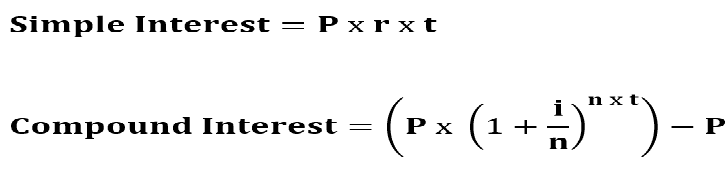

“Simply” put, when calculating compound interest, interest is applied on interest over the period of compounding.

Where:

P = Principal

i = Annual Nominal Rate of Interest (In many places you will see “r” instead of an “i“, both mean the same)

n = Compounding periods per year

t = Tenure in years

Please see the first two sections of the attached excel which explain Simple and Compound Interest with examples.

Real World Fact: The more the number of times money is compounded, the higher is the future value. Often you will notice that banks and financial institutions lend money with monthly compounding but borrow (read “create fixed deposits”) at quarterly compounding. So they earn more and pay less!

Additional Reference Material:

[download_after_email id=”1979″]

Effective and Nominal Rates of Interest

Effective Rate of Interest is just the annual equivalent rate taking account of compounding.

The difference in both causes a lot of confusion and more so because IRR and NPV use the Nominal Rate and XIRR and XNPV use the Effective Rate. So we must know how to reconcile these two.

The two relevant formulas in MS Excel are:

- =Effect(Nominal rate, no of compounding periods) – This will convert the Nominal Rate into the Effective Rate.

- =Nominal(Effective Rate, no of compounding periods) – And this will do the opposite.

Additional Reference Material:

Amortization Schedule

This is one of the first things a student of finance and commerce learns.

It simply shows with each compounding period how the interest gets accumulated and how the principal gradually reduces as the installments of a loan or are paid off.

This is also the format in which you generally receive your bank and loan statements.

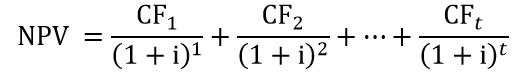

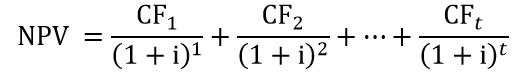

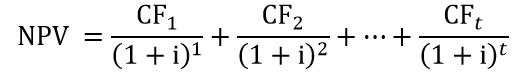

3. Net Present Value

Net present value is the present value of the cash flows at the required rate of return of your project compared to your initial investment.

Where:

CFt = Net Cash Flow in the period t

I have calculated a simple example in the same excel. Please refer Columns M and N. Note there is only one cash in-flow in Column P. Generally we will have more than one.

I have again calculated the NPV in Column N rows 4, 5 and 6 using the mathematical formula.

Row 4 – By taking the Annual Nominal Rate

Row 5 – By taking the Monthly Nominal Rate

Row 6 – By taking the Annual Effective Rate

I am sure you note that all give the same result. If the correct formula is used with the correct rate then this is expected. But in a complex excel, if a wrong combination is used, it can really be difficult to find the mistake!

The understanding of these subtle differences is extremely critical.

We must also understand here how MS Excel works:

- Every excel row is a 30 day compounding.

- Which also means Excel assumes a 360 day year and not 365.

- NPV and IRR formula use Nominal Rates with 360 day year.

- XIRR and XNPV use Effective Rates with 365 day year.

For a live example please download another excel from my post Operating Lease vs. Finance Lease.

Additional Reference Material:

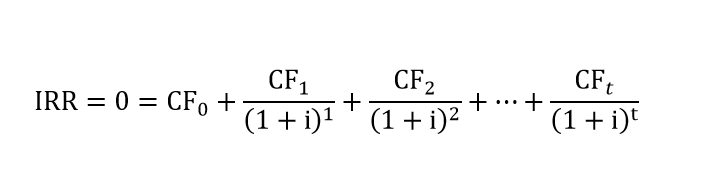

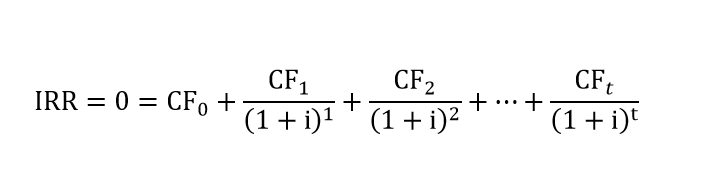

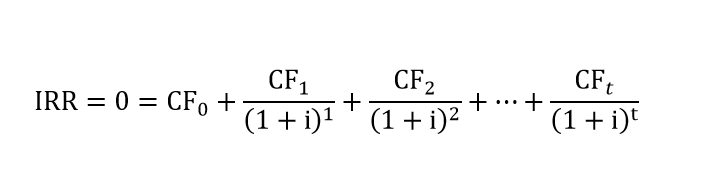

4. Internal Rate of Return

The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

Let us move to Column P in the same excel now.

There are only two cash flows, one “outflow” at the beginning of the period and the other “inflow” at the end. IRR will be the rate which will make the NPV of these cash flows together as ZERO. We have already calculated that in Column M and N above in the NPV section. Note that in Cell P14 we have multiplied the IRR by 12 to give the Annual Nominal Rate otherwise we get the Monthly Nominal Rate.

Few Common mistakes to avoid:

- Don’t leave a blank row in between – If you do so, excel assumes that row does not exist. Play around while deleting some of the Zero’s between cells P17 to P27

- Don’t forget to multiply by 12 to get the Annual Nominal Rate.

Real World Fact: What the banks quote to you when you got to take a loan is generally the Annual Nominal Rate.

Additional Reference Material

Conclusion

This covers the minimum basic we need to know regarding Time Value of Money. Compound Interest is the base and IRR and NPV are the two most popular formula in use.

Part 2 of this series covers XIRR and XNPV and how they relate to IRR and NPV. It also covers NPV Factor and Days 360.