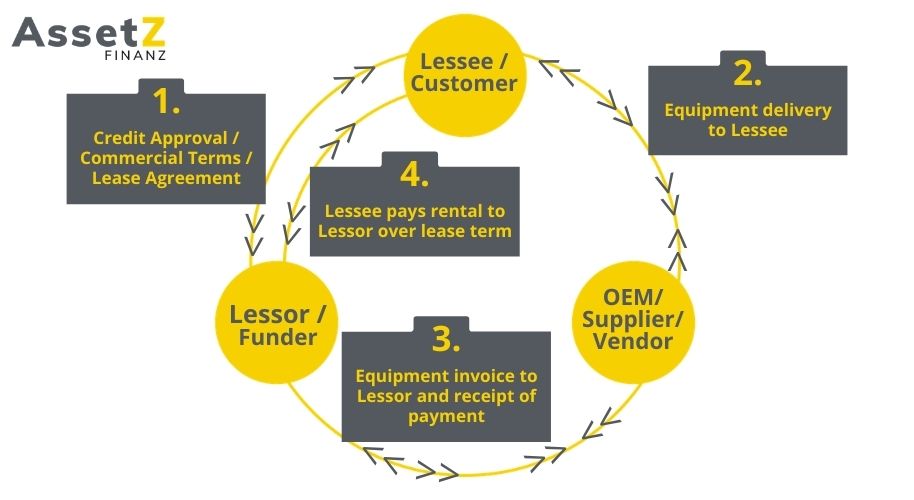

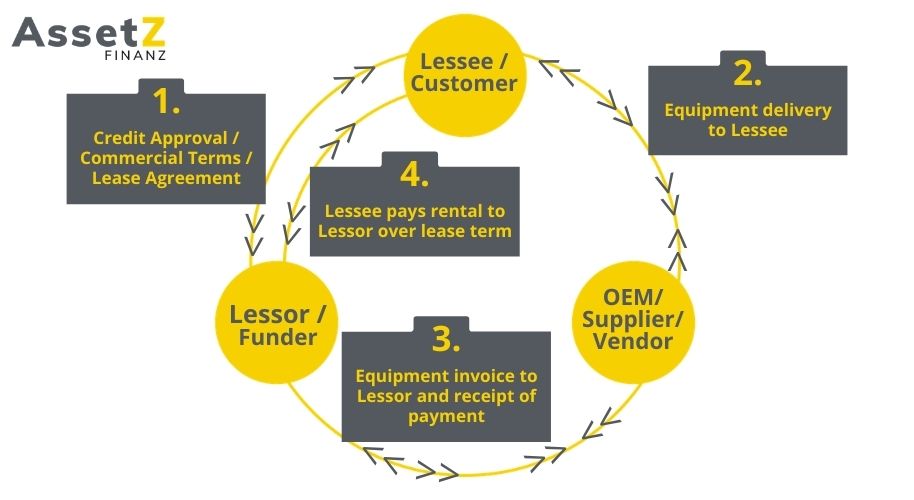

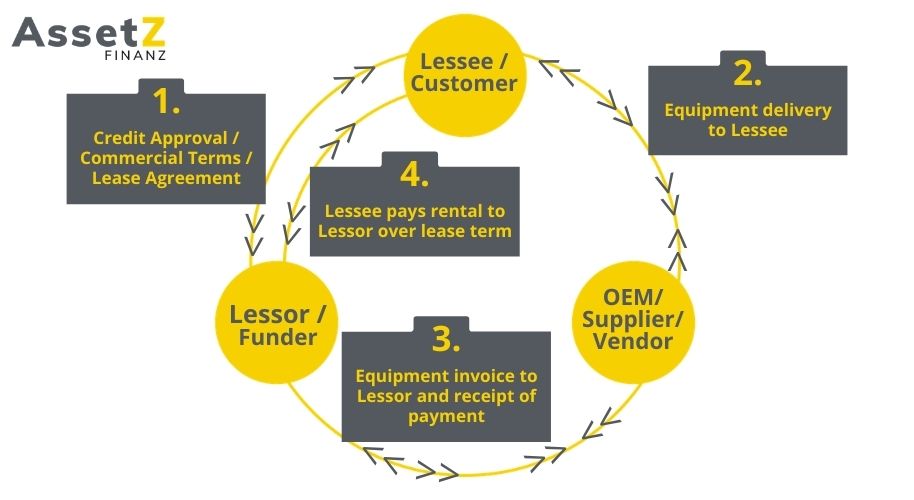

Equipment Leasing is essentially Renting. A Lessor, who owns the equipment, gives it to the Lessee, who uses the equipment for a defined period, in return for periodic payments.

Renting, in common parlance, is for a shorter term of few months where there may or may not be a lock-in period whereas equipment leasing is generally longer, between 2 to 5 years, and with a lock in period.

If the Lessor provides additional support and services the lease is classified as a Wet Lease, otherwise it’s a Dry Lease.

Several factors determine whether a lease is an Operating Lease or its a Finance Lease. Let us explore those factors in this post.

Simple Process Flow

Definitions

The Classical definitions as per InD AS 116 are as follows:

A lease is classified as a Finance Lease (FL) if it transfers substantially all the risks and rewards incidental to ownership of an underlying asset.

A lease is classified as an Operating Lease (OL) if it does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset.

Ind AS 116 also goes on to add:

“Whether a lease is Finance Lease or Operating Lease depends on the substance of the transactions rather than the form of the contract.”

I just cannot stress enough how important the above statement is. How a particular transaction is classified, has many ramifications.

This will be a recurring discussion as we navigate equipment leasing!

Distinguishing Between OL And FL

Accounting Standards have given us a few indicators regarding how to distinguish between the two. There are 5 major indicators to suggest that a transaction is a Finance Lease.

1. Full Payout Test

If the present value of the minimum lease payments almost recover the fair value of the equipment, the transaction is a Finance Lease.

This is the first and the most important test which everyone resorts to. And actually most of the organizations just classify the lease as an Operating Lease or a Finance Lease based on this one test.

Let us understand the key terms here in a little more detail:

- Present Value – For arriving at the present value, the interest rate used for the discounting is either the interest rate implicit in the lease, and if not readily determinable, it can be the Lessee’s incremental borrowing rate. The Implicit Rate of Interest is – “The rate of interest that causes the present value of (a) the lease payments and (b) the unguaranteed residual value to equal the sum of (i) the fair value of the underlying asset and (ii) any initial direct costs of the lessor.”

- Minimum Lease Payments – They include all fixed payments but exclude any Security Deposit or Processing Fee. In-substance fixed lease payments are payments that may, in form, contain variability but that, in substance, are unavoidable.

- “Almost recover” – How is this ascertained? If the present value is less than 90% of the fair value of the equipment, the transaction can be classified as an Operating Lease. Now this figure of 90% is mentioned in the US GAAP but we don’t have any such number in India. We just follow the global norm.

For the Lessor the discounting rate can only be the implicit rate in the lease!

[download_after_email id=”2151″]

2. Transfer Of Title Test

An equipment lease will be classified as a Finance Lease if at the inception it is known that the Lessee will get the ownership of the underlying equipment at the end of the lease term.

3. Bargain Purchase Option Test

An equipment lease will be classified as a Finance Lease if the lease provides an option to the Lessee to buy the equipment at the end of the tenure at a bargain purchase price which is expected to be substantially lower than the fair market price at that time and which the Lessee is reasonably certain to exercise.

4. Lease Term Test

An equipment lease will be classified as a Finance Lease if the lease term is for the major part of the economic life of an equipment. The threshold here is generally taken as 75% but it is not explicitly defined anywhere.

5. Equipment Is Specialized Test

An equipment lease will be classified as a Finance Lease if the equipment is of specialized nature which only the Lessee can use without major modifications.

Ind AS 116 goes on to add other situations where the lease can be classified as a Finance Lease.

- If any cancellation losses are borne by the Lessee.

- If changes in fair value of residual asset are borne by the Lessee

- If the Lessee can continue the lease for a secondary period at a substantially lower rent.

And lastly it goes on to say that all of the above may not always be conclusive and there may be other features which may help in deciding if the lease transfers substantially all the risks and rewards.

From the above it is clear that the Accounting Standards have gone to great lengths to help us understand how a lease needs to be qualified.

Why Is This Distinction Important

The question we must ask ourselves is why is this distinction important.

It is important because certain accounting and regulatory aspects depend on this classification.

Accounting – Operating Lease and Finance Lease are accounted for in different manner in the books of accounts. It can have a great impact, especially for equipment which are under lower depreciation rates as per the Income Tax Act.

An interesting development is the concept of Synthetic Leases in India. These are Finance Lease transactions structured and shown as an Operating Lease. We will cover Synthetic Lease in another post.

Ind AS 116 has tried to address this issue by proposing the same accounting standard for both Operating and Finance Lease for the Lessee. But it only succeeds partially.

NBFC Classification – Anyone can give equipment on Operating Lease. There are no restrictions. But if a Lessor is giving equipment on Finance Lease, beyond a certain threshold, they have to look at the RBI Act which says that where the financial assets of the company are more than 50% of the total assets and the financial income generated by the company is more than 50% of the its total income, then the company is required to register itself as an NBFC.

Whether a Lessor decides to operate as an NBFC or not, has a significant impact on its competitiveness. Read more about it on my post Know Your Lessor.

Conclusion

Equipment Leasing can become a complex transaction. The Accounting Standards have gone to great lengths to explain and cover everything.

But there are still many grey areas in the Operating Lease vs. Finance Lease debate. This has greatly influenced how the equipment leasing industry has developed. Understanding the basic classification criteria is our first step as we navigate through the equipment leasing landscape.