Equipment leasing can be an efficient way to acquire equipment provided you know what equipment to lease and on what terms. First and foremost, that requires a deep understanding of the equipment itself.

Let us try and understand what makes different types of equipment good or bad for leasing.

Various Equipment Classes

In India Equipment Leasing is slowly gaining traction and there are certain type of equipment which you can acquire on lease. Some such equipment are:

– Aircraft

– Automobile

– Commercial Vehicles

– Construction Equipment

– Technology Equipment

– Healthcare Equipment

– Plant & Machinery

– Furniture & Fitout

– Renewable Energy

Worldwide however it is possible to lease the following type of equipment also:

– Farm / Harvesting

– Fitness Equipment

– Cleaning Equipment

– Aesthetic Devices

– Food Processing

– Surveying & Testing

– Industrial Tools

A good question to start with is what type of equipment are good candidate for leasing? There must be some attributes which can help both lessors and lessees decide for which type of equipment, leasing is a good strategy.

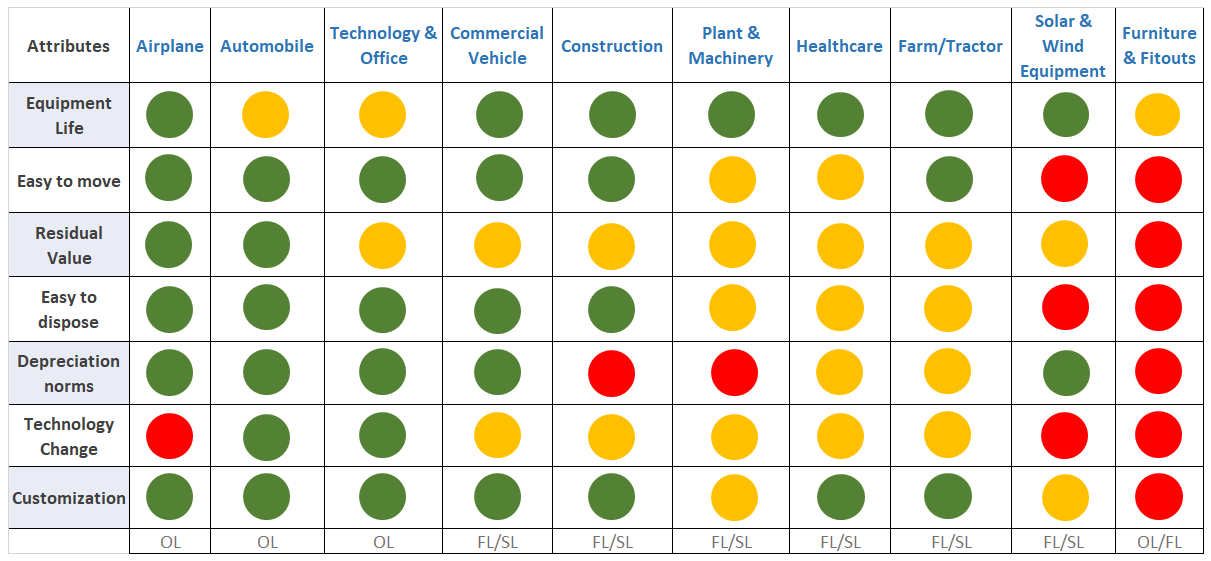

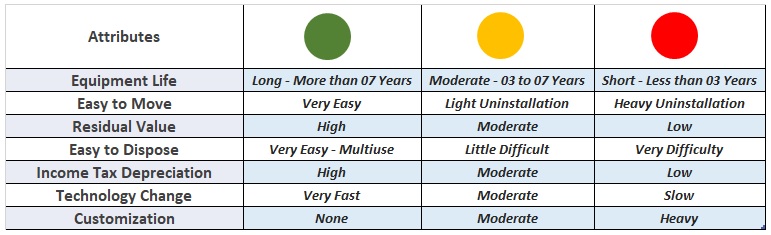

In the below table, I have tried to map several attributes of different equipment.

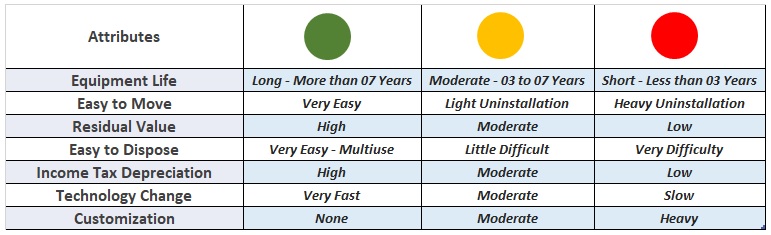

A rough legend for the above table:

But these attributes really do not seem to help us decide on what equipment should we lease!

Residual Value

Equipment Leasing is all about one thing – Residual Value.

Generally speaking, any equipment which has a good residual value at the end of term and which is easily movable should be leasable.

For such equipment, leasing is a win-win acquisition or financing option. The Lessee gets to use the equipment for a period of its choice, at a lower cost, conserving its cash flows and with great administrative and operational flexibility. After the lease term is over, the equipment then goes in the secondary market and is used by other companies who derive benefits out of its residual value.

Thus, equipment leasing is a great way to share equipment and derive maximum value out of it.

Is Residual Value A Good Indicator For A Lease?

At first glance it seems obvious that true operating lease is possible where both the Lessor and the Lessee understand and agree that the equipment has Residual Value.

But is it so? Let us take see examples.

Construction Equipment – It fits the bill. Construction Equipment definitely has a good residual value if we consider a true operating lease for a 3 to 5 year tenure. They are also easily moveable. But if you analyze the industry and specifically the NBFC’s who are into financing of Construction Equipment, you will hardly see any of them offering true operating lease for a tenure ranging from 3 to 5 years.

Shriram Transport Finance, Mahindra Finance, HDB Financial Services, Sundaram Finance, Tata Capital etc. are all mostly offering a loan to acquire Construction Equipment.

Commercial Vehicles and Farm Equipment – We take the same line of thought as for Construction Equipment and again you will observe that the larger NBFC’s hardly offer a true operating lease for these equipment.

The same once again applies to Plant & Machinery and Healthcare Equipment though these are relatively difficult to move.

Even though most of the equipment have good residual value, these do not seem to be popular with leasing companies. Why is this so?

The Real Criteria For True Operating Lease

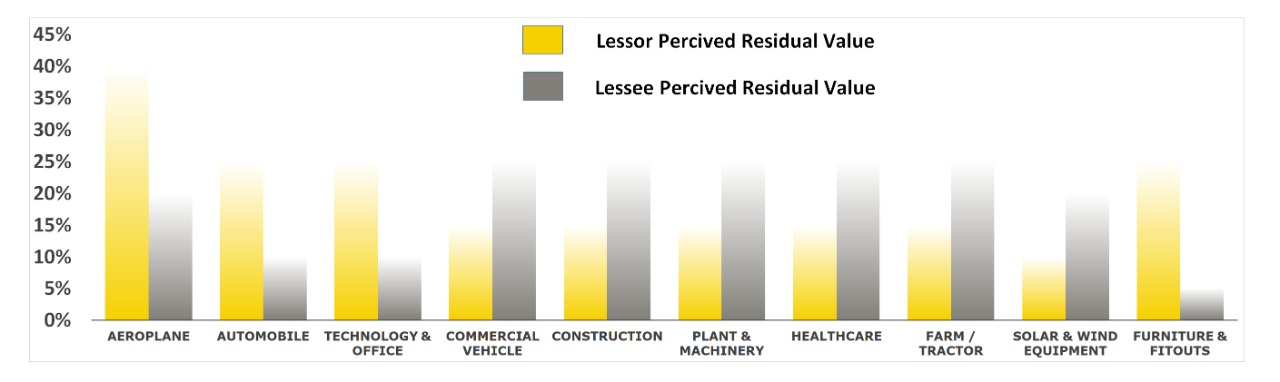

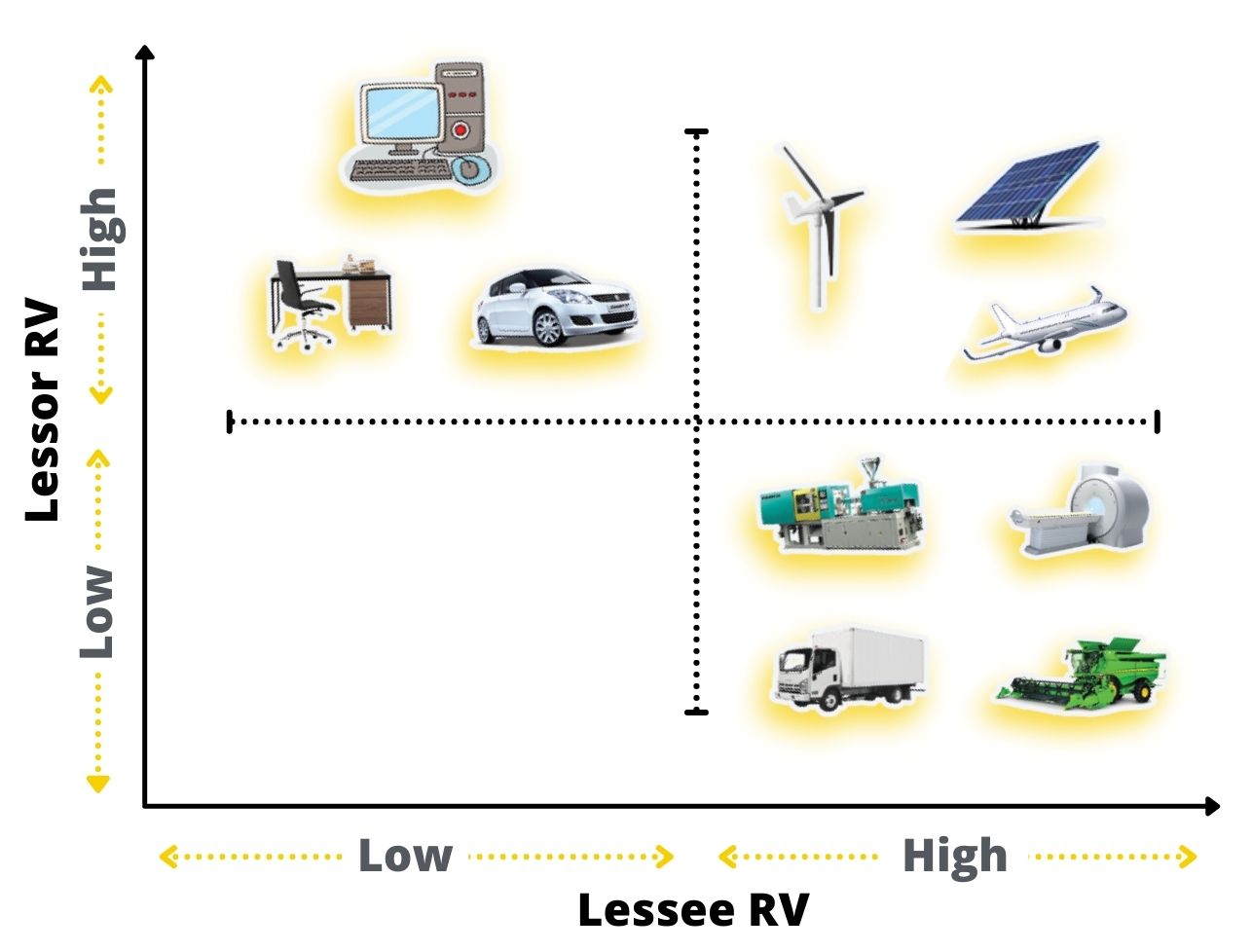

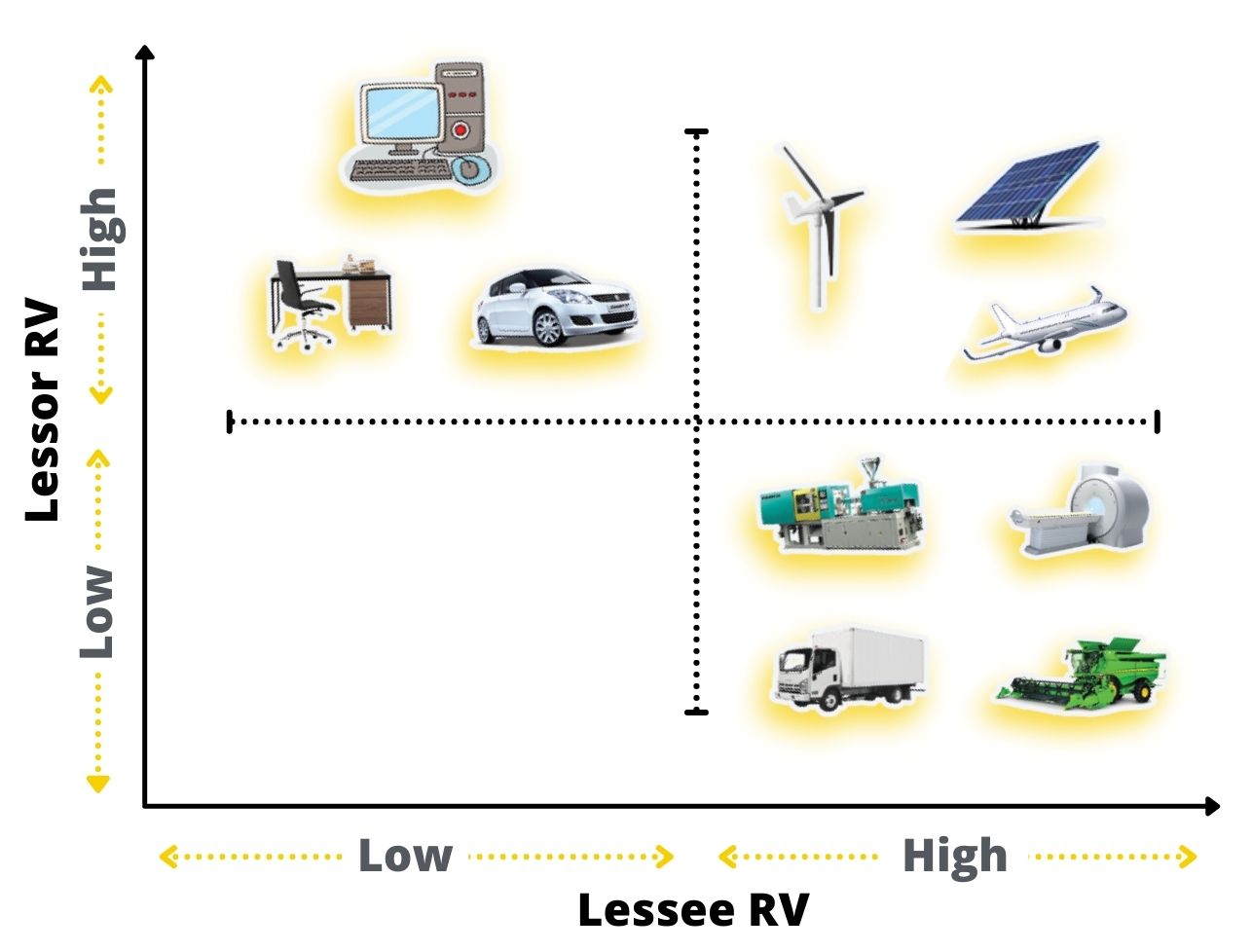

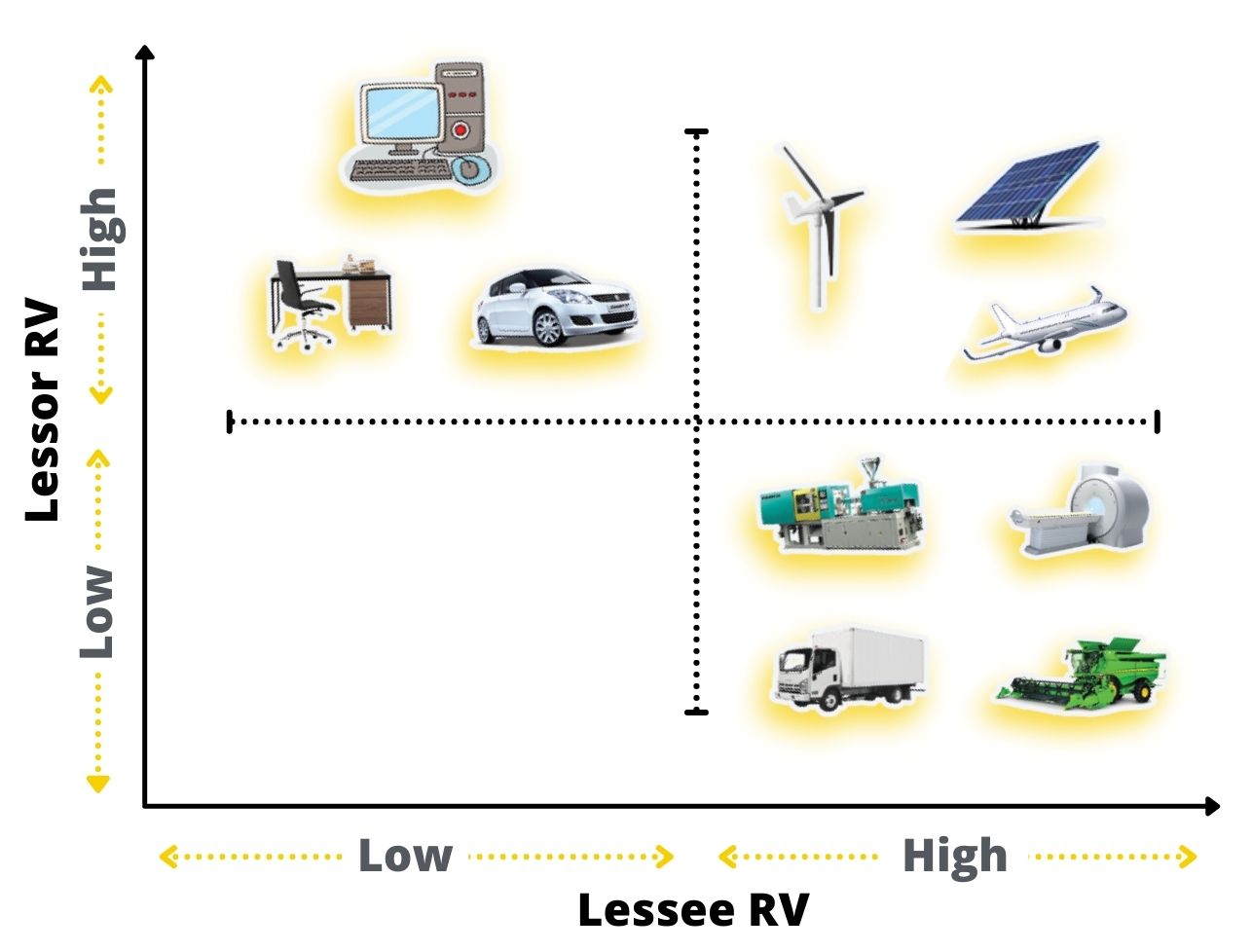

Leasable equipment is that equipment for which the Lessor perceives a higher Residual Value than the Lessee.

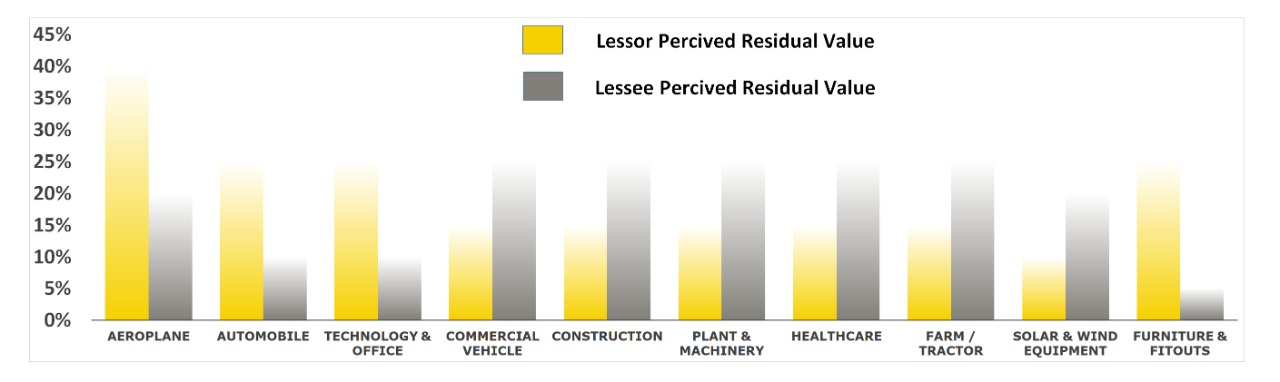

Let us look at another table below:

Let us examine some more equipment categories here.

Automobiles – Automobiles are one of the most leased category of equipment worldwide. They are a fast depreciating asset.

Technology & Office – Again a fast depreciating equipment class and an essential tool for any industry now. Automobiles and Technology Equipment both experience very rapid technological change and the Lessees tend to replace them quickly. The Lessors of these equipment have a deep understanding of these equipment and access to a well developed secondary market.

Commercial Vehicle, Construction Equipment, Plant & Machinery, Healthcare Equipment, Farm Equipment are all classes for which the Lessee associate a much higher Residual Value till the very end of their economic life.

And since the Lessee has a higher perceived Residual Value as compared to the Lessor there is no true Operating Lease.

Airplane and Solar / Wind Power Generation Equipment – Both are very long lasting equipment with the key difference that Airplanes are of course made for movement whereas it is very difficult to move Solar / Wind equipment once installation is done.

Furniture & Fitout – A very interesting equipment class. Very difficult to move but with much shortened economic life in today’s times.

The below graphic is a simpler way to visualize the Residual Value difference.

Conclusion

A clear understanding of the inherent attributes of the equipment and more importantly, how its Residual Value is differently perceived by the Lessor and the Lessee are important to create the correct leasing product which benefits both the Lessor and the Lessee.